Key Inclusions

§ An executive summary of the insights captured during our research. It offers a high-level view on the current state of oral solid dosage contract manufacturing market and its likely evolution in the mid-long term.

§ A general overview of oral solid dosage contract manufacturing, highlighting details on the various types and components of oral solid dosage forms. Additionally, it presents information on the oral solid dosage (OSD) manufacturing process. Further, it highlights the emerging trends in OSD manufacturing domain, featuring information on the commonly outsourced manufacturing operations. The chapter concludes with a discussion on key considerations while selecting a CDMO partner, the affiliated risks and future perspectives of growth in this domain.

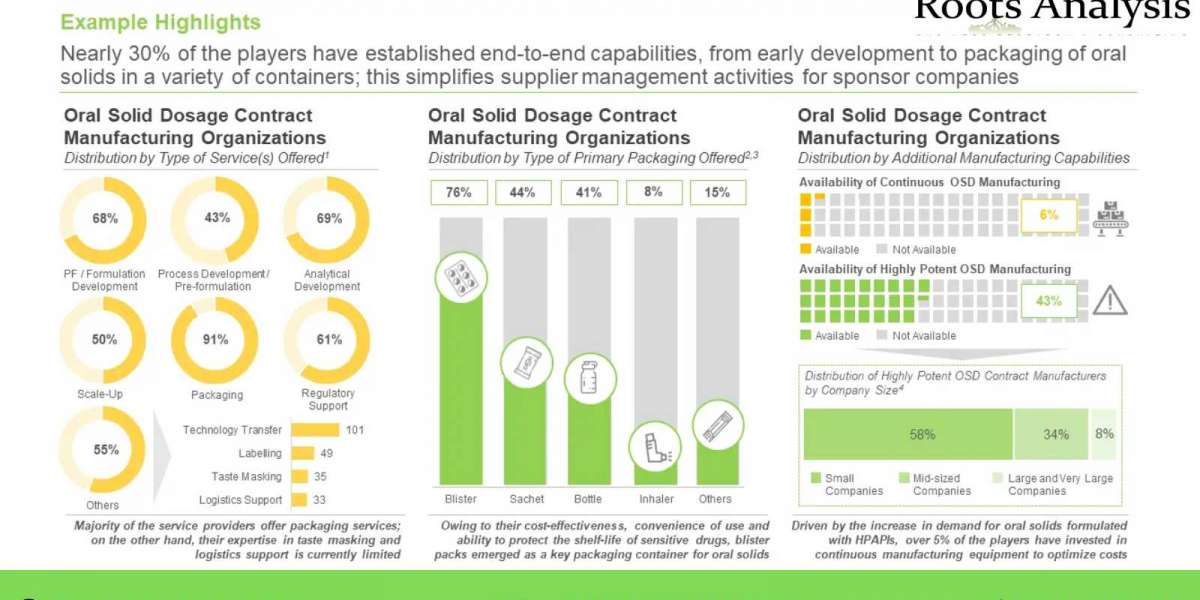

§ A detailed assessment of the overall market landscape of the companies offering oral solid dosage contract manufacturing services, based on several relevant parameters, including year of establishment, company size (in terms of number of employees), location of headquarters, company ownership (privately held and publicly owned), type of service(s) offered (pre-formulation / formulation development, process development, analytical, scale-up, packaging, regulatory and others), type of finished dosage form(s) manufactured (tablets, capsules, granules, multi-particulates and others), type of packaging offered (bottles, blisters, sachets / pouches / bags, inhalers, and others), scale(s) of operation (preclinical, clinical, and commercial) and additional manufacturing capabilities (continuous oral solid dosage manufacturing and highly potent oral solid dosage manufacturing.

§ A detailed competitiveness analysis of oral solid dosage contract manufacturing service providers based on supplier strength (in terms of years of experience) and service strength (considering type of service(s) offered, type of finished dosage form(s), type of packaging offered, scale(s) of operation, regulatory certification(s) and location of facilities).

§ A detailed analysis of the capabilities of oral solid dosage contract manufacturers established across the key geographical regions (North America, Europe, Asia-Pacific and Rest of the World), based on several relevant parameters, including type of type of service(s) offered, type of finished dosage form(s) manufactured, type of packaging offered and scale(s) of operation. It also features information on the location of manufacturing facilities of the service providers.

§ Elaborate profiles of key players engaged in the contract manufacturing of oral solids (shortlisted based on strength of service portfolio). Each profile includes a brief overview of the company, its financial information (if available), details on its oral solid dosage service portfolio, manufacturing capabilities and facilities, and recent developments and an informed future outlook.

§ An insightful make versus buy framework, highlighting the various factors that need to be taken into consideration by oral solid dosage drug developers, while deciding whether to manufacture their respective products in-house or engage the services of a CMO or CDMO partner.

§ A detailed analysis of the recent expansions (since 2018) undertaken by various service providers in order to augment their respective oral solid dosage contract manufacturing portfolios, based on a several relevant parameters, including year of expansion, purpose of expansion (capability expansion, capacity expansion, facility expansion, new facility), type of finished dosage form, geographical location of expanded facility, and most active players (in terms of number of expansions).

§ An estimate of the global installed capacity (in terms of number of oral solid units and volume of API) for the manufacturing of oral solids, based on information provided by various industry stakeholders in the public domain. It also features distribution of the available capacity on the basis of company size (small, mid-sized, large and very large firms), scale of operation (preclinical, clinical and commercial), type of finished dosage form (tablets, capsules, and others) and key geographical regions (North America, Europe, and Asia-Pacific and Rest of the World). Overall, the analysis represents a holistic view of the supply-side of the market, allowing us to present an informed opinion on whether the present capacity will be able to meet the likely future demand.

§ An informed estimate of the annual clinical and commercial demand for oral solids (in terms of volume of API), across key geographical regions and therapeutic areas.

§ A detailed analysis of the total cost of ownership for an oral solid dosage contract manufacturing service provider, highlighting the expenses associated with the establishment and maintenance of an oral solid dosage manufacturing facility, over a period of 20 years.

§ A detailed discussion on various guidelines laid down by major regulatory bodies, across different countries, featuring an elaborative assessment of over 300 CMOs engaged in this domain, along with information on their operational approvals, certifications received, and relative popularity of the key regulatory body. Additionally, the chapter features an insightful multi-dimensional bubble analysis, presenting a comparison of the current regulatory scenario in key geographies.

§ A case study on the current market landscape of taste masking service providers, providing information on their year of establishment, company size and location of headquarters. In addition, the chapter provides details in the services offered (taste masking, and taste assessment), scale of operation (preclinical / clinical and commercial), manufacturing scalability, other service(s) offered along, type of formulation (tablets, granules, capsules, semi-solids and others), techniques used for taste masking (hot melt extrusion, microencapsulation, coating, ion exchange resin and others), branch of healthcare (pediatrics, geriatrics and others) and regional capability.

§ A case study on the overall market landscape of bioavailability enhancement service providers, based on several relevant parameters, such as year of establishment, company size (in terms of number of employees), location of headquarters, bioavailability enhancement principle supported (solubility enhancement, absorption enhancement, sustained release and others), bioavailability enhancement approach employed, including [A] solid dispersion (spray-dried dispersion, hot melt extrusion, polymers, agglomeration / granulation, lyophilization, inclusion complexes, super critical fluid, solvent evaporation and other solid dispersion approaches), [B] size reduction (conversion to nanotechnology-based formulation, high pressure homogenization / micronization, bead layering, microfluidics, and other miscellaneous size reduction approach), [C] lipid-based (liposomes, self-emulsifying drug delivery system, excipients, micelles, lipid-nanotechnology based formulations and other lipid-based formulations), and other bioavailability enhancement approaches (co-crystallization, chemical modification, and other miscellaneous bioavailability enhancement technologies), and type of dosage form supported (solids, fine particles and semi-solids).

The financial opportunity within the oral solid dosage contract manufacturing market has been analyzed across the following segments:

§ Type of Finished Dosage Form

§ Tablets

§ Capsules

§ Granules

§ Powders

§ Others

§ Type of Packaging

§ Bottles

§ Blisters

§ Sachets

§ Strips

§ Stick Packs

§ Scale of Operation

§ Pre-commercial

§ Commercial

§ Company Size

§ Small

§ Mid-sized

§ Large

§ Very Large

§ Therapeutic Areas

§ Oncological Disorders

§ Cardiovascular Disorders

§ Metabolic Disorders

§ Neurological Disorders

§ Genetic Disorders

§ Respiratory Disorders

§ Immunological Disorders

§ Other Disorders

§ Key Geographical Regions

§ North America

§ Europe

§ Asia-Pacific

§ Latin America

§ Middle East and North Africa

Key Questions Answered

§ What is the global market size of oral solid dosage manufacturing market?

§ Which are the top players in the oral solid dosage contract manufacturing market?

§ How many contract service providers possess capabilities to handle oral solid therapies with highly potent APIs (HPAPIs)?

§span style="font-variant-numeric: normal; font-variant-east-asian: normal; font-variant-alternates: normal; font-kerning: auto; font-optical-sizing: auto; font-feature-settings: normal; fon<