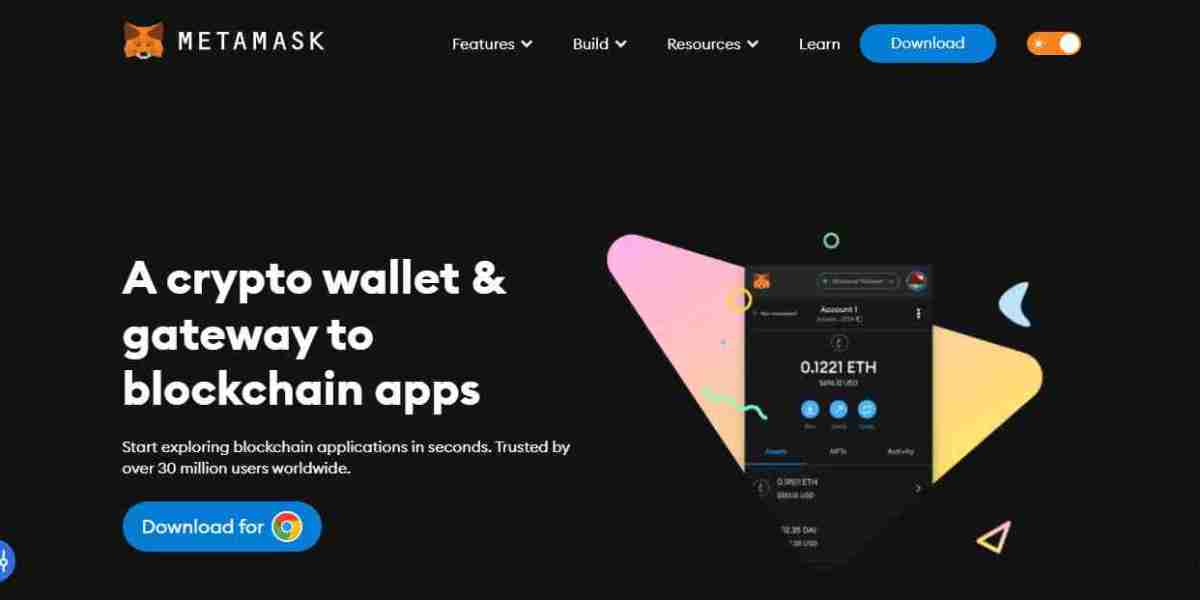

Welcome to the world of decentralized finance made simple with MetaMask. If you're diving into the

exciting world of cryptocurrencies, MetaMask is your getaway. This user-friendly extension serves as

your digital wallet, connecting you to a world of decentralized applications (DApps) on the blockchain.

Whether you're new to crypto or a professional investor, MetaMask makes managing your digital assets

a breeze.

In this blog, we'll delve into the basics of liquidity pools on MetaMask Chrome Extension, explaining how

to add liquidity, the risks involved, and the potential rewards. Get ready to uncover the operations

behind liquidity pools and enhance your understanding of decentralized world with MetaMask.

What are MetaMask Wallet Extension Liquidity Pools?

Liquidity pools on MetaMask Extension are like the heartbeat of decentralized finance (DeFi), simplifying

the way users engage with cryptocurrencies. Imagine a digital place where users contribute their coins

to facilitate trading – that's a liquidity pool. These pools form the backbone of decentralized exchanges,

ensuring smooth transactions and efficient pricing.

On MetaMask Wallet, joining a liquidity pool involves adding your cryptocurrency tokens to a pool,

allowing others to trade against them. In return, you earn a share of the trading fees generated. It's a

simple yet powerful way to participate in DeFi and make your crypto work for you.

Working of Liquidity Pools

Imagine you put $2000 in stablecoins and 0.5 ETH into a special savings pool on MetaMask Extension.

Right now, that's like putting in about $4,000 altogether. In return, you get 200 special tokens that show

you own part of the pool. Each token represents a piece of your deposit, like $10 and 0.0025 ETH. Keep

in mind, that the values can change because of prices going up or down, but that's a different thing

called 'impermanent loss.' With these special tokens, you can easily add or take out your money from

the savings pool on MetaMask Wallet Extension. It's like a flexible way to manage your savings,

converting the special tokens back to the regular coins or the other way around. It's a cool feature on

this amazing MetaMask Wallet platform.

Additional facts on Liquidity Pools

If you decide to trade these special tokens (LP tokens) directly for another currency like ETH or BNB

using tools like MetaMask Swaps or other platforms, a few things might happen:

You might get a very low offer for your tokens.

If you use MetaMask Swaps, you could see a warning that the price isn't available because

not many people are trading these tokens.

Even if you go ahead with the trade, you might end up with only a tiny part of the value you

originally put into the savings pool of MetaMask Wallet Extension.

Remember, once you make this trade, it's final. The blockchain can't undo any transactions,

including this one.

Unfortunately, you won't be able to go back and take out your savings; by making this trade,

you've given up your ownership proof.

Summing it Up!

In conclusion, MetaMask Wallet Extension works as a user-friendly gateway to the decentralized world

of cryptocurrencies and decentralized finance (DeFi). With its easy setup, secure features, and seamless

interaction with various decentralized applications, MetaMask empowers users to manage their digital

assets efficiently. From sending and receiving tokens to participating in liquidity pools, MetaMask opens

doors to a new era of financial possibilities. As the landscape of blockchain technology evolves,

MetaMask continues to play a vital role in making decentralized finance accessible and user-friendly for

individuals worldwide. It's not just a wallet; it's a perfect way to the decentralized future. Further, in

case of any query reach out to the customer care executive anytime.